During the last 18 months, one of the ASX’s toughest sectors has been micro-cap technology. These businesses usually feature everything the market has hated; they are small, illiquid, cash burning and reliant on external capital to survive let alone grow. Against the backdrop of rising interest rates, the dislike for the sector has been profound and the selling indiscriminate.

As is often the case, the best opportunities arise in periods of panic and this time is no different. Listed in 1998, Prophecy International (ASX: PRO) was originally a holding company that acquired, developed and spun off various software solutions. In 2017 a new strategy emerged, centred around the two products with the best growth prospects; Snare, a cybersecurity monitoring solution and eMite, a contact centre analytics solution.

One-Off to Recurring Revenue

2017 was the same year current CEO Brad Thomas joined as the eMite’s General Manager of Sales. One of his first decisions was changing eMite’s go to market from lumpy on-premise licencing deals to cloud deployment subscription revenue.

The move created a much higher quality revenue base along with a product offering that could be continually upgraded via the cloud. Lengthy and complex integrations with legacy on-premise infrastructure became a thing of the past.

However, this wasn’t a seamless transition from a financial view. Rather than recognising big chunks of revenue and cash upfront from a perpetual licence sale, the company receives a smaller recurring payment. This is a better business model, but it takes a few years for this to be noticed in the numbers as the recurring base builds.

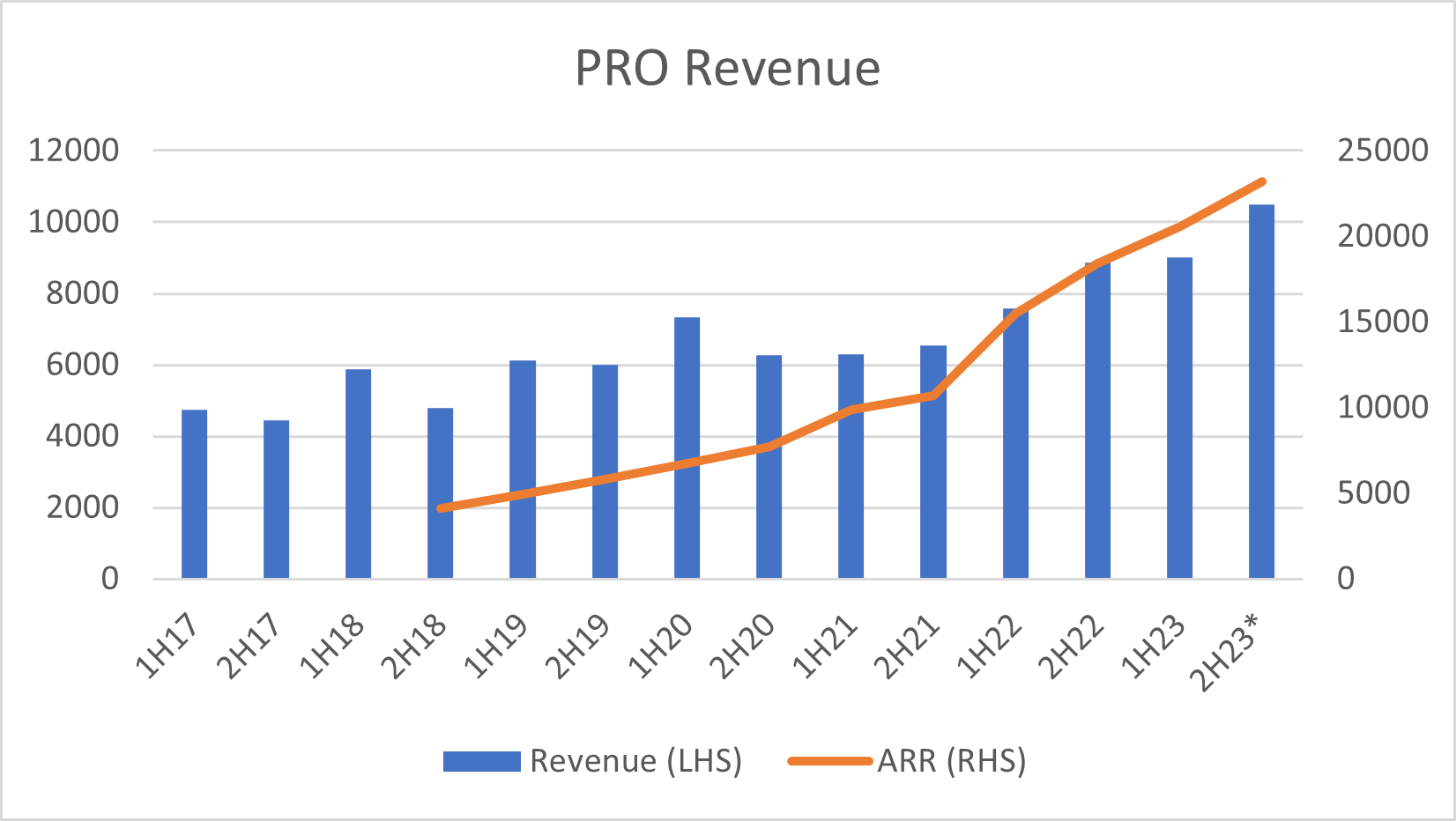

In the meantime, financial results are messy. The chart below shows lumpiness between FY17 to FY20 with first half results stronger due to the seasonality in upfront Snare licence sales. In FY21, as recurring revenue became the major driver, management began consistently reporting annualised recurring revenue (ARR) to better emphasize the underlying growth.

From 2021 onwards, a smoother revenue trajectory began to emerge, but the recent 1H23 result saw revenue lumpiness return as Snare now began the transition to a subscription model.

While Snare’s Government and Defence customers still prefer perpetual licences, the subscription model has been gaining traction, with over 75% of non-Government and Defence customers opting for it over upfront licensing.

Since offering the subscription model, Snare’s recurring revenue has increased from zero in FY21 to $4.2m in FY23. Like eMite, it will take time before the recurring revenue base overwhelms the lumpy licencing fees. However, this creates a potential opportunity for long-term investors who understand how the revenue transition impacts short term financial results.

eMite

eMite is an out of the box customisable solution sold to customers running large and complex contact centres. It is an analytics product that ingests data from multiple feeds and generates real-time insights and performance dashboards.

Deployed in the cloud, eMite is perfectly positioned to benefit as contact centres make the switch to cloud hosted solutions. The product’s two main sales channels are the cloud-hosted Genesys AppFoundry and Amazon Connect. While Amazon Connect has been built in the cloud, Genesys still has many customers with legacy on-premise solutions.

However, this is about to change. In October last year, Genesys announced it would no longer be supporting its legacy Engage solution and would be encouraging customers to migrate across to their cloud offerings.

Prophecy also recently released an update to eMite for an integration platform as a service, that will allow for integration with other cloud infrastructure providers like Twilio and TalkDesk. This opens a new sales channel and broadens eMite’s already large addressable market.

Snare

Snare is a cyber security monitoring solution providing compliance, alerting, reporting and analysis of data across multiple sources in complex systems. Despite targeting different end customers, the core of eMite and Snare are similar; ingesting copious amounts of data and presenting it in a usable way for customers.

Prophecy describes Snare as answering three key questions in the event of a potential cyber security breach:

- Did someone get in?

- How did they get in?

- What did they see/take/change?

Where Snare differs from eMite is while it can be provided as a cloud solution, many customers (particularly Government and Defence) require on-premise solutions, often in air gapped networks disconnected from the internet.

Like eMite, Snare also has structural tailwinds. Governments worldwide are implementing data logging standards to ensure if a cybersecurity breach does occur, the extent of the problem can be quickly determined. Elevated scrutiny from recent cyber intrusions at Optus and Medibank mean products like Snare are perfectly positioned for further growth.

FY22: A Foundational Year

While Brad Thomas has been instrumental in improving operations since taking the helm in 2017, it wasn’t until FY22 that the business truly hit its stride. Prophecy won the largest contracts in its history for both products; eMite signed US health insurer Humana to a $1.8m ARR contract and Snare signed the UK Royal Navy to a $700k licence.

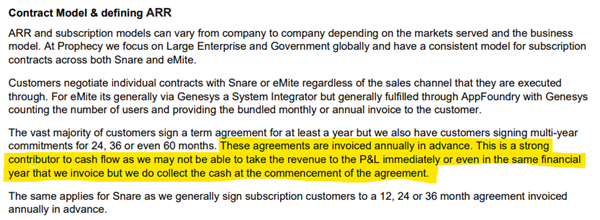

While reported revenue growth was solid (+28%), the strongest growth came from deferred revenue as Prophecy collects cash up front annually before revenue recognition (see image from FY22 Annual Report below). Deferred revenue grew 89% and contributed to $2.9m operating cashflow for the year. Given Prophecy ceased capitalising their development costs in FY19, almost all of this converts to free cashflow.

Unfortunately, last financial year’s record growth has not been repeated in FY23, with ARR growth slowing from 71% in FY22 to 26% in FY23. At the same time cost inflation, elevated growth expenditure and unfavourable foreign exchange combined to push the $2m free cashflow in FY22 back to breakeven.

Outlook

Slowing growth and declining profitability saw Prophecy’s share price fall from highs of $1.63 to below 50c earlier this year (since recovering somewhat on the back of some new contracts). However, with $23m+ in ARR and 110 employees globally, Prophecy is far from a struggling, unprofitable micro-cap like peers it is often lumped in with. Despite FY23 being more of a consolidation year, the company will be roughly cashflow breakeven, maintain a debt free balance sheet with $12m in cash and have the foundations in place to win more business in two structurally growing markets.

Further, Prophecy has several characteristics closer to higher quality large cap software peers. Genuine software as a service based recurring revenue, strong negative working capital cycle (receives cash from customers ahead of recognising revenue), fully expensed research and development costs and no large share-based payment expenses. All of this is on top of a 40% CAGR of Prophecy’s ARR since FY18, completely organic with no acquisitions.

Valuation

Valuations for businesses like Prophecy around the profitability/free cashflow inflection point is tricky. With $23m of ARR plus another $1-2m in annual Government/Defence Snare licences, Prophecy will enter FY24 as breakeven business.

However, the jaws of operating leverage could be about to open substantially as easing cost pressures mean any incremental revenue should increasingly fall to the bottom line. Wage pressure in the IT space has moderated and a falling AUD is a benefit given the majority of revenue is earned in USD. Most importantly however is after a large increase in headcount over 2022 (90 in March 2022 to 110 in March 2023) to support the operational growth, the platform is in place to grow profitably moving forward.

With the established ARR base, it will only take modest revenue growth (15-20%) in FY24 to see Prophecy produce $2-3m in profit. With a current market capitalisation of $45m and $12m cash in the bank, ~13x earnings is a very reasonable multiple for an organically growing software business that exhibits the characteristics found in high quality peers operating in two large addressable markets with strong structural tailwinds.

Luke Winchester, Inception Fund Portfolio Manager

Disclaimer: The material contained within this document about the Merewether Capital Inception Fund (“Fund”) has been prepared and is issued by Authorised Representative No. 001292724 (Merewether Capital Management Pty Ltd) of AFSL No. 534584 (ARC Funds Operations Pty Ltd). Figures referred to in document are unaudited. The document is not intended to provide advice to investors or take into account an individual’s financial circumstances or investment objectives. This is general investment advice only and does not constitute advice to any person. Neither Manager nor the Fund’s trustee (Evolution Trustees Limited ACN 611 839 519, AFSL No 486217 (“Evolution”)) guarantee repayment of capital or any rate of return from the Fund. Neither Evolution nor the Manager gives any representation or warranty as to the reliability, completeness or accuracy of the information contained in this document. Investors should consult their financial adviser in relation to any material within this document. Past performance is not a reliable indicator of future performance. Investors should consider any offer document of the Fund and any other material published by the Manager or Evolution in deciding whether to acquire units in the Fund. This information is available at https://www.merewethercapital.com.au/.